|

|

#1 |

|

Участник

|

dynamicsax-fico: Project related intercompany cost allocations (2)

Источник: https://dynamicsax-fico.com/2016/11/...allocations-2/

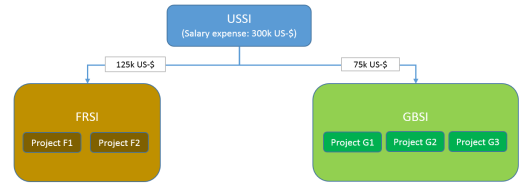

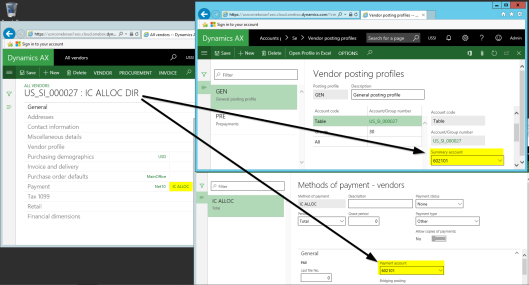

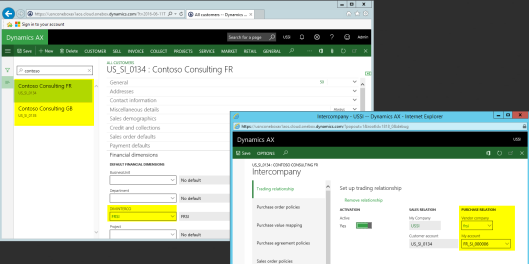

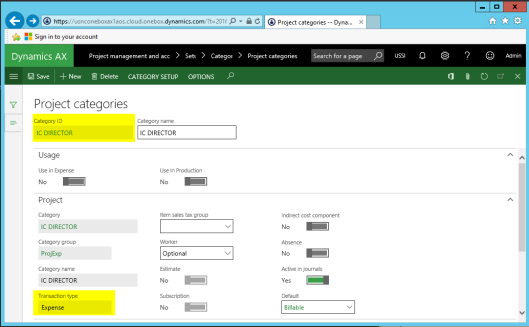

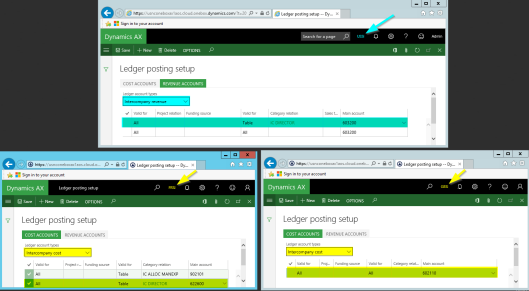

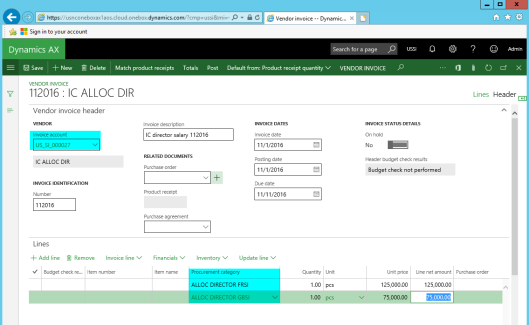

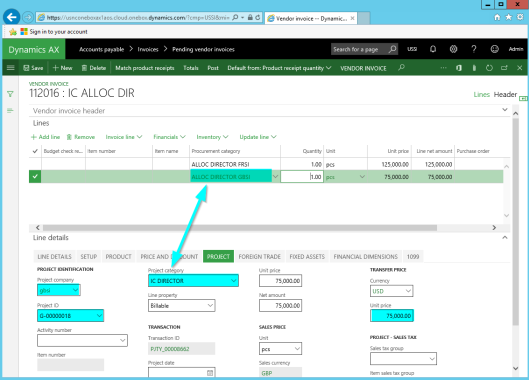

============== Example 2: Allocating the costs of corporate directors working in corporate headquarters to the projects setup in other companies Part A: Scenario The prior post introduced the standard project intercompany functionality for time sheet transactions. Within this post I would like to modify and extend this scenario by analyzing how the costs of corporate directors can be allocated to projects in other legal entities that they – at least from time to time – supervise. An underlying assumption of this scenario is that the directors do not record their time in Dynamics AX but rather that only their salary expense is recorded in the corporate headquarters company (USSI). The next graph illustrates the corporate structure used for the following illustrations and shows that the director’s salary expense shall (partly) be allocated to the projects setup in subsidiary FRSI and subsidiary GBSI.  Note: What is important when it comes to the allocation of indirect costs across different legal entities is that regulators / tax authorities regularly require tax invoices and the adherence to international transfer pricing regulations to prevent companies from shifting their profits to low tax countries. This is an aspect that will also be taken into consideration subsequently. Part B: System setup For the following illustrations I will use an approach similar to the one introduced in an earlier post. That is, the cost of the corporate directors will first be invoiced and recorded on company-specific summary projects (F0 and G0) from where they will be allocated to the different projects in a second process-step. The next graph illustrates this procedure from a high-level perspective.  In order to implement this scenario, a couple of setups are necessary that I will illustrate next before having a look at the different process steps involved. Setup B.1: Intercompany dummy vendor account company USSI The first thing that needs to be setup for the illustration of this scenario is a dummy vendor account in the corporate headquarters company USSI that will be used as an intercompany invoice “vehicle”. Three things require special attention when setting up this dummy vendor account. First, the use of a Profit & Loss (P&L) summary account No. 602101 that is used as the offset account for the cost allocations recorded. Second, the (optional) setup of a separate method of payment for this dummy account to avoid an unlimited increase of the dummy vendor account balance and third the (optional) linkage of the summary account to fixed financial dimension values that offset those financial dimensions that will be used when recording the directors salary expenses in Dynamics AX.  Setup B.2: IC customer & vendor accounts Once the dummy vendor account is setup in the headquarters company, intercompany customer and vendor accounts need to be setup in all companies participating in the intercompany scenario. When setting up those intercompany customer and vendor accounts it is important that an intercompany financial dimension value is setup as default value, as exemplified in the next screen-print. Otherwise, the financial consolidation process of the corporate ledger accounts might get difficult later on.  Setup B.3: Project category setup The third setup is related to the project category that will be used for the intercompany invoicing and allocation of the director’s costs. There is nothing special to look out for when setting up this category except that it is setup in all companies.  Please note that I linked the IC Director category to the transaction type “expense”. Setup B.4: Procurement category setup company USSI After the project category setup is finished, procurement categories need to be defined that will be used for creating the intercompany postings later on. When I setup those procurement categories, I noticed that Dynamics AX summarized my transactions irrespective of the financial dimension values used. For that reason, two – rather than a single – procurement categories will be used in the following.  Please note that both procurement categories are linked to the same project category that has been setup previously. To record project transactions later on based on those categories, corresponding ledger accounts need to be setup in the inventory posting matrix. In the example illustrated above, the ledger accounts 602310 and 602320 represent intercompany P&L salary allocation accounts. Details for their usage can be investigated further below. Setup B.5: Project setup companies FRSI & GBSI No specific setup is required for the internal (allocation) and external customer projects in the subsidiaries except that one should ensure that they are all linked to a default intercompany financial dimension value at a minimum.  Setup B.6: Project posting setup The last setup required relates to the setup of the project ledger posting. In this respect you have to setup an intercompany revenue account in the corporate headquarters company that allocates the costs to the different subsidiaries. To get those allocated costs posted in the subsidiaries, the subsidiaries require the setup of intercompany cost accounts. The next screen-print exemplifies the ledger posting setup required in the different companies involved.  (Please note that the corporate headquarters company USSI and the subsidiary GBSI share the same Chart of Accounts (COA). The FRSI subsidiary does, on the other hand, use its own local COA). In addition, as the allocated intercompany costs will subsequently be distributed to the different external customer projects by making use of the project adjustment functionality, one has to ensure that the intercompany cost account setup is also made in the project costing section. That is because the latter posting type will be used for the distribution of the costs to the different projects.  Note: The project ledger posting setup shown above is based on the use of time & material projects. If you use other project types, a slightly different ledger posting setup might be required. Part C: Process steps Step C.1.: Record the directors salary expense in USSI With all those setups in place, the intercompany cost allocation process can start with the recording of the directors’ salary expense – for reasons of simplicity – in an ordinary General Ledger journal.  Please note that I recorded the salary expense together with a business unit and department financial dimension value. The voucher resulting from this transaction debits a P&L account and credits the Balance Sheet (BS) account that records the salaries payable.  Step C.2.: Record internal invoice transaction on dummy vendor account in USSI The next step involves a pure internal transaction that is required for the subsequent generation of the intercompany invoices. This internal process step involves recording an internal vendor invoice on the dummy vendor account setup and makes use of the previously setup procurement categories. In the example used and illustrated in the next screen-print, a total of 200k USD is allocated to the other companies (125k USD to company FRSI and 75k USD to company GBSI) involved in the intercompany relationship.  Please note that the internal invoice transaction is made in reference to the intercompany project category and summary project as shown in the next screen-print.  Posting this internal invoice, results in the following voucher …  … which is summarized in the next accounting overview.  (IC = Intercompany financial dimension, PRO = Project financial dimension) What one can identify from the illustration above is that – due to the specific ledger accounting setup made – the internal invoice transaction does not influence the overall profitability of the corporate headquarters company USSI because the ledger accounts used for the debit and credit transaction are both P&L accounts. From an overall accounting perspective, the only thing that has changed through this internal invoice transaction is that the total corporate directors’ salary expense is broken up into different parts.

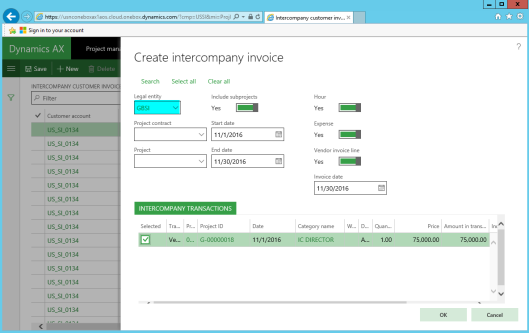

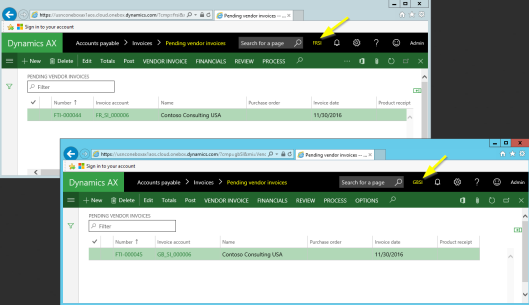

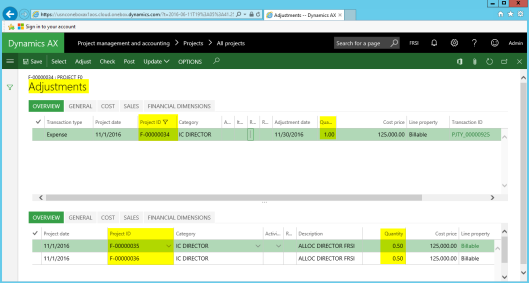

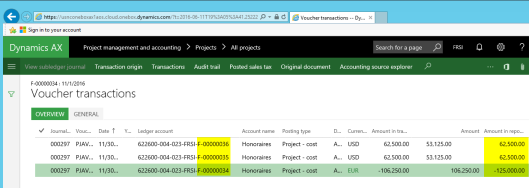

Once the internal invoice transaction is recorded, the intercompany project invoices can be generated. This is realized through the standard Dynamics AX intercompany project functionality illustrated in the next screen-print.  A major advantage of using this standard functionality is that the intercompany invoice document is – as exemplified in the next screen-print – automatically created out of the box.  The voucher resulting from this intercompany invoice transaction debits an intercompany receivable (BS) account and credits a P&L account that offsets the previously recorded expense allocation accounts.  The next accounting overview illustrates the offsetting effect mentioned above in the yellow highlighted accounting sections.  Due to this offsetting effect the total directors’ salary expense remaining in the corporate headquarters company is reduced from 300k to 100k USD (sum of the ledger accounts 602100, 602310, 602320, 602101 and 603200). Step C.4: FRSI & GBSI: Post pending vendor invoices At the time the intercompany project invoice is recorded in the corporate headquarters company, pending Accounts Payable vendor invoices are automatically created in the subsidiary companies FRSI and GBSI. Please see the next screen-print.  Posting those invoices results in the following vouchers:  Please note that the voucher recorded in the subsidiary companies record the transaction in USD – the currency that was specified when posting the intercompany invoice – and the accounting currency of the subsidiary (EUR resp. GBP in my case). What currencies are used for the intercompany invoicing process is not only an accounting issue but also a transfer pricing and organizational issue, as it determines which legal entity has to bear the risk of foreign exchange rate changes. As before, the next accounting overview, summarizes the intercompany invoice transactions recorded in all companies involved in the intercompany trading relationship.  Step C.5: FRSI & GBSI: Allocate transactions to the different subprojects One of the last steps in the intercompany allocation process is the distribution of the allocated costs to the different projects in the subsidiaries. This can be achieved by making use of the project adjustment functionality that has been introduced in a prior post and which is illustrated in the next two screen-prints.   The resulting vouchers are once again summarized in the next accounting overview.  As one can identify, the adjustment / allocation posting in the different companies ensured that all costs are finally distributed down from the corporate headquarters level to the project level in the subsidiaries. The remaining two process steps related to the intercompany allocation are not explicitly illustrated here, as they are not directly related to the intercompany cost allocation process.

Summary Within this post I illustrated how indirect costs recorded in corporate headquarters can be allocated across legal entities down to the different projects processed in the different subsidiaries. An important aspect of this process is that the required intercompany tax invoices and all required accounting transactions can be created out of the box with the standard Dynamics AX intercompany project functionalities. The next and final post in this series on project related cost allocations will focus on a scenario where costs / revenues recorded at the project level of the different subsidiaries will be allocated back to the corporate headquarter level for cost analysis purposes. Filed under: Project Tagged: cost allocations projects, indirect costs, intercompany, overhead Источник: https://dynamicsax-fico.com/2016/11/...allocations-2/

__________________

Расскажите о новых и интересных блогах по Microsoft Dynamics, напишите личное сообщение администратору. |

|

|

|

|

| Опции темы | Поиск в этой теме |

| Опции просмотра | |

|